Introduction

The Stock Trading Bot is a Python-based application that uses historical stock market data to predict future stock price movements, specifically focusing on companies within the S&P 500. The bot is capable of suggesting potential trades based on predicted price trends.

Problem

Accurately predicting stock prices is a complex challenge due to market volatility, noise, and unpredictable external factors. Many beginner trading tools oversimplify the analysis, leading to poor trading decisions based on incomplete data.

Goal

By utilizing historical stock data and applying predictive algorithms, the Stock Trading Bot aims to provide users with better-informed trading suggestions. It uses statistical analysis and machine learning techniques to detect patterns and make probabilistic forecasts about future price trends.

Results

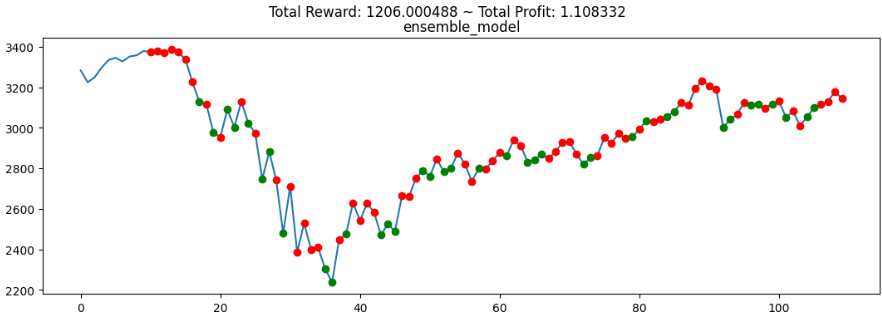

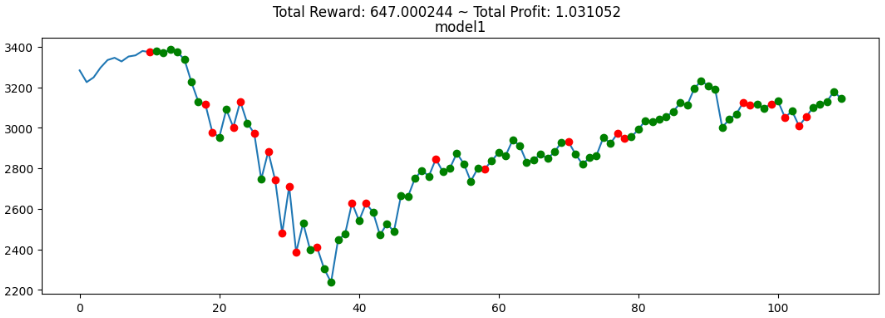

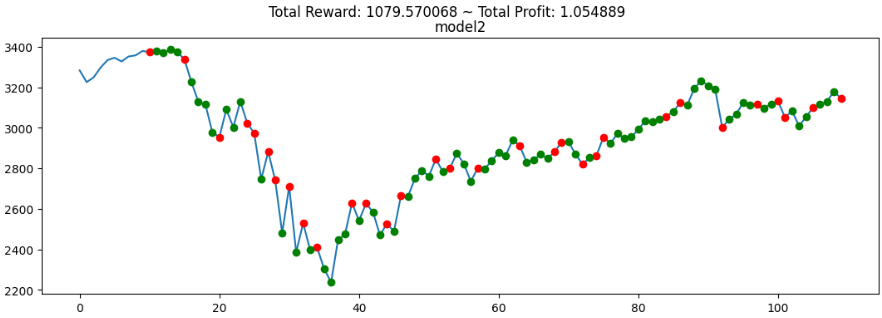

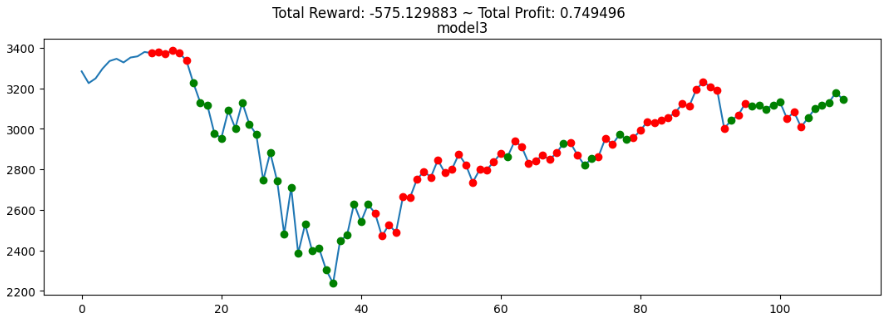

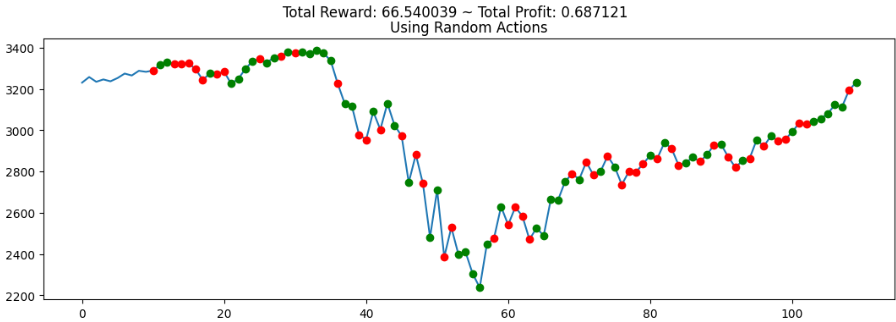

Based on our findings, using temporal ensembles could potentially boost the trading bot's performance in certain situations. However, the agents don't consistently produce positive returns. There is possibility of negative returns and underperformance (which may be caused by the hyperparameters, the market conditions, and even the model itself) even though there were previous instances of positive returns.

Key Features

- Collects and processes historical stock market data

- Implements predictive models to forecast future stock prices

- Generates buy/sell trading signals based on predicted trends

- Supports backtesting with historical data to validate model accuracy

- Modular design for easy adaptation to other stock indexes or assets

Technologies Used

Python, Pandas, NumPy, Scikit-learn, Matplotlib, Yahoo Finance API

Gallery

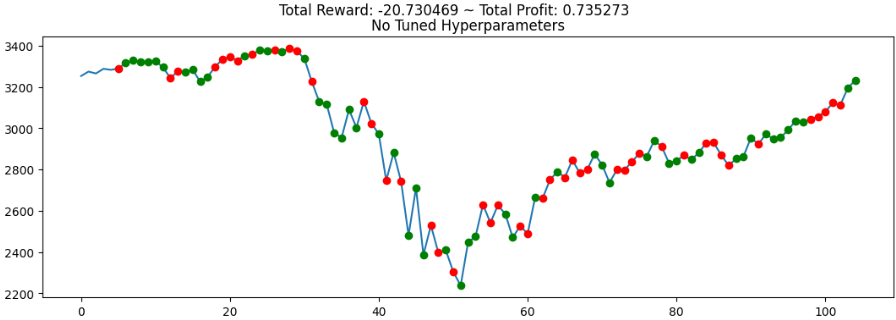

In the following charts, the red dots indicate sell and the green dots indicate buy.

Ensembled Model

Model1

Model2

Model3

Random Actions (Baseline)

No Tuned Hyperparameters (Baseline)